In this latest note directed toward followers, fans and fellow tax fighters . . . Preston Smith points us in the direction of curious data revelations.

Here's part of his note with the most interesting bit highlighted . . .

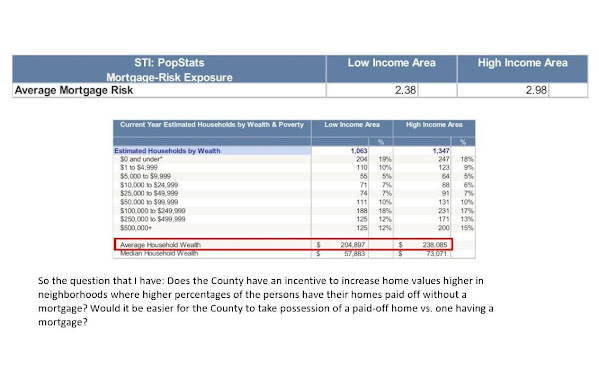

"Maybe your readers can figure out how mortgage debt figures into all this. I can't. I do know that the County informed most lenders in February/March about the increased taxes, because I was getting calls/emails from taxpayers then because their mortgage escrow had started taking out more for taxes before the taxpayers ever got their notices.

"There has to be some connection here."

Indeed . . .

Even better . . .

Check more of number crunching and raw data courtesy of a Mr. Preston Smith amid rising public push back against historically high rising property taxes . . . Here are more sides, info and observations sent our way . . . And then news updates after that . . .

Read more via www.TonysKansasCity.com links . . .

Jackson County couple feeling taxed after lengthy property assessment appeals process

KSHB 41 reporters talked to experts who said for weeks the best way to dispute a Jackson County property assessment is to file an appeal.

Residential property values are up 40% in Jackson County. How does your area compare?

Check out our interactive map to see residential property value increases in your local school district.

Jackson County property appeals top 51k and keep growing, tensions mount against Frank White

It's the largest number of people to appeal in recent memory. In 2019′s controversial assessment, about 30,000 people appealed.

Developing . . .

Comments

Post a Comment

TKC COMMENT POLICY:

Be percipient, be nice. Don't be a spammer. BE WELL!!!

- The Management